From the President’s Desk

From the President’s Desk

Rick Lindemann

Greetings All:

Spring is here, business is booming, life is good, smooth sailing, right? Not necessarily.

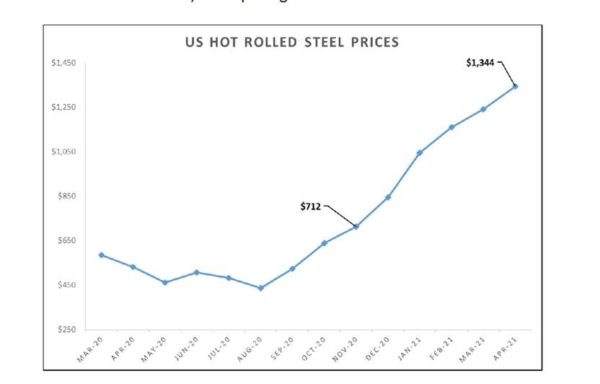

Unless you have been living under a rock, you can’t help but experience the new challenges that come with the increase in business. We all get price increase notifications from our suppliers, struggle with long lead-times and late deliveries, and so on and so on.

I’ve put together a collection of information that I have received over the last several weeks Hopefully the information is helpful to understand the situation and prepare you to better explain it to your customers. As far as what to do about it?

Here are a few things that we are doing to cope with what’s happening:

- Pass on price increases as soon as you get them, huge profit loss if your cost goes up but your sell price does not.

- Manage your inventory, buy ahead of a price increase if you can, cautiously analyze what you carry, and stock up if necessary, to ride out supply chain shortages. After all, he who has the inventory gets the sale.

- Scour the surplus inventory lists. Many companies are carrying overstock that they would be thrilled to get rid of.

- Study your freight charges. Freight costs are going up drastically for various reasons. In one instance we found there was an over-length charge for shipping a 19-foot piece of material. Because the packaging made it 21 feet, there was a 40% increase in the shipping charge.

These are just a few things we try to do to manage expense and profitability. If you have others, please share.

Best Regards,

Rick Lindemann

Some information to continue to keep everyone aware of the issues and it’s not changing.

|